The National Retail Federation is the world’s largest retail trade association.

Every day, we passionately stand up for the people, policies and ideas that help retail succeed.

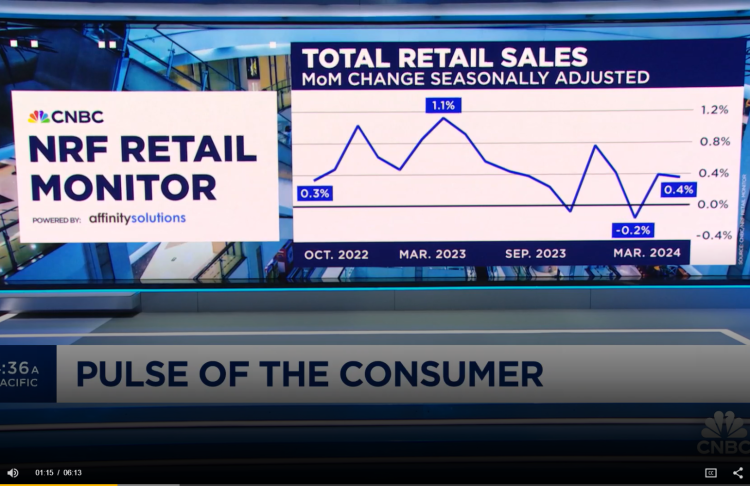

CNBC/NRF Retail Monitor, powered by Affinity Solutions, shows retail sales grew in March amid wage gains and easing inflation for goods.

Explore the new report, The Economic Contribution of the U.S. Retail Industry, compiled by PwC, to see a view of the retail industry by the numbers, including employment, number of retail establishments, labor income and impact on GDP across the country and in your state.

Watch the event from March 20, 2024

NRF’s State of Retail & the Consumer explored the health of American consumers and the retail industry with leaders including Walmart U.S. President and CEO John Furner, NRF President and CEO Matthew Shay, NRF Chief Economist Jack Kleinhenz, Ph.D., and economic and consumer experts.

Latest from NRF

IBM’s Institute for Business Value Global Research Leader, Consumer Industry, Jane Cheung discusses IBM’s 2024 consumer study, “Revolutionize retail with AI everywhere.”

Nashute Ragster-Manuel, a business teacher at Green Oaks Performing Arts Academy in Shreveport, La., uses the RISE Up training program in her classroom teaching her students foundational skills to help them get hired in retail and forge a path to success after graduation.

SmartBrief newsletters

Want to be the first to know about the latest retail news? Choose from five curated editions and subscribe for free.